Back when I was a teenager, I had to go through first aid training in order to become a lifeguard. One of the key areas of focus in the class was what to do when you come across someone who is on the ground and is injured or unconscious. My memory is hazy on what all the steps were, but I can clearly remember the first one. In my head I can still hear the instructor calling out, “ASSESS THE SITUATION!”

In this scenario, the first thing that we were taught to do was gather information: scan the scene, check to make sure things were safe, look for clues about what caused the injury, ask bystanders or the patient (if conscious) what had happened, and check for a pulse or bleeding.

The point being: before you can help someone effectively, you need to understand what is going on and what the situation is.

This is also 100% the case with your personal finances.

Even without putting in much effort, you can probably tell whether you are doing great or poorly with your finances. But if you really want to improve in this area, you need to dig a little deeper. You need to “assess the situation.”

I think it’s extremely beneficial for everyone to know their income, their monthly expenses, and the balances of their financial accounts. By tracking where you stand financially, you’ll have greater awareness of where you are and what you need to do to get where you want to go.

If this sounds too difficult to you, because perhaps you don’t want to spend time looking up all your bank statements or tracking your spending on an Excel spreadsheet, (salesman voice…) DO I HAVE THE SOLUTION FOR YOU. What if I told you there was a free app/website that would track everything for you? That would keep track of all of your spending, your investment balances, and your net worth in real time?

It’s called Personal Capital.

All sales pitch joking aside, this is a great piece of software that I literally use every day. But before I tell you the reasons why I suggest you use it too, let me give you a bit of anecdotal evidence of its awesomeness.

Within the past year I have gotten a couple other friends to use it as well.

Friend 1 told me, unprompted, recently, “I love this app. It’s the best. I use it every day.”

Friend 2 said, “I cut my expenses by like 30%, because before I had no idea how much I was actually spending.”

So, what is Personal Capital?

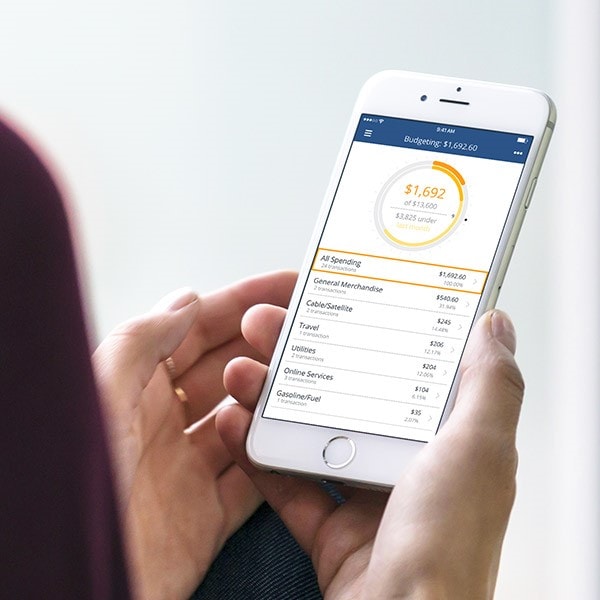

Personal Capital is a one-stop shop for keeping track of all of your finances. It aggregates the data from all of your accounts into one simple interface. There is another popular competitor out there called Mint (I have both), but I definitely prefer using this one.

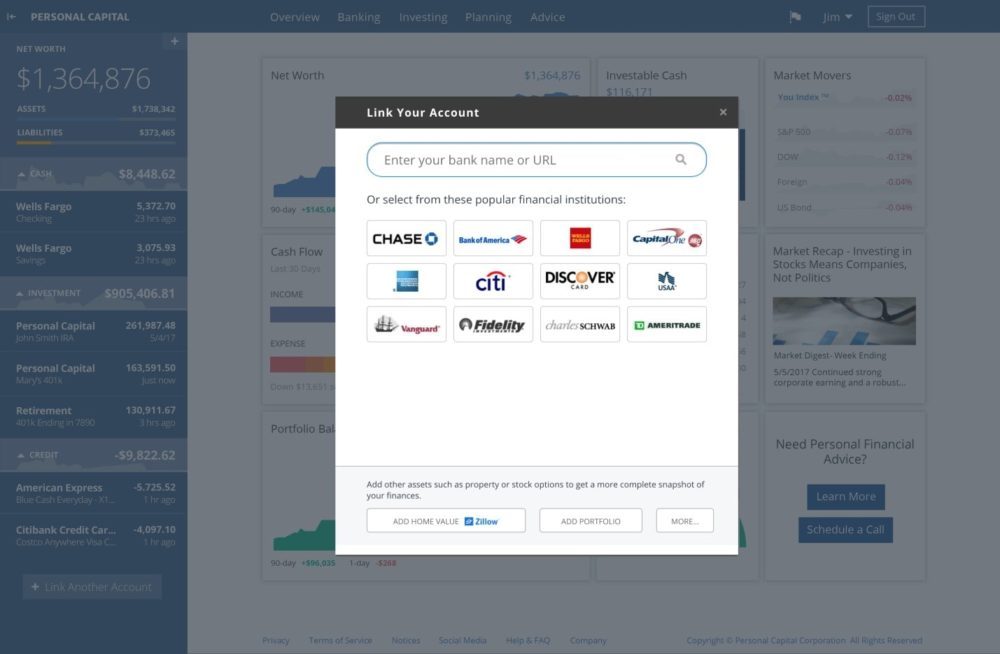

You simply link all of your bank accounts, credit cards, and investment accounts by entering your login info for each. This then allows the software to look up the balances of each of those accounts.

I know what you’re probably thinking: I have to put in all my passwords?? Is that safe? What if they get hacked? Quick note on this: At Personal Capital, data safety is the number one priority. They have very strong multi-layer encryption and internal access controls. Personal Capital is a financial institution with over 1.6+ million users. They do everything in their power to keep data safe, because if they don’t, they risk losing their entire customer base if trust is broken. Financial Samurai (a much more famous personal finance blogger) can probably explain it better here if you’re worried. Check out some of his other articles while you’re at it.

So, you’ve decided to sign up and get all of your financial accounts linked. Note: in order to get a full financial picture, be sure to put in all of your accounts—even things like your home and mortgage too.

This is where things start to get fun.

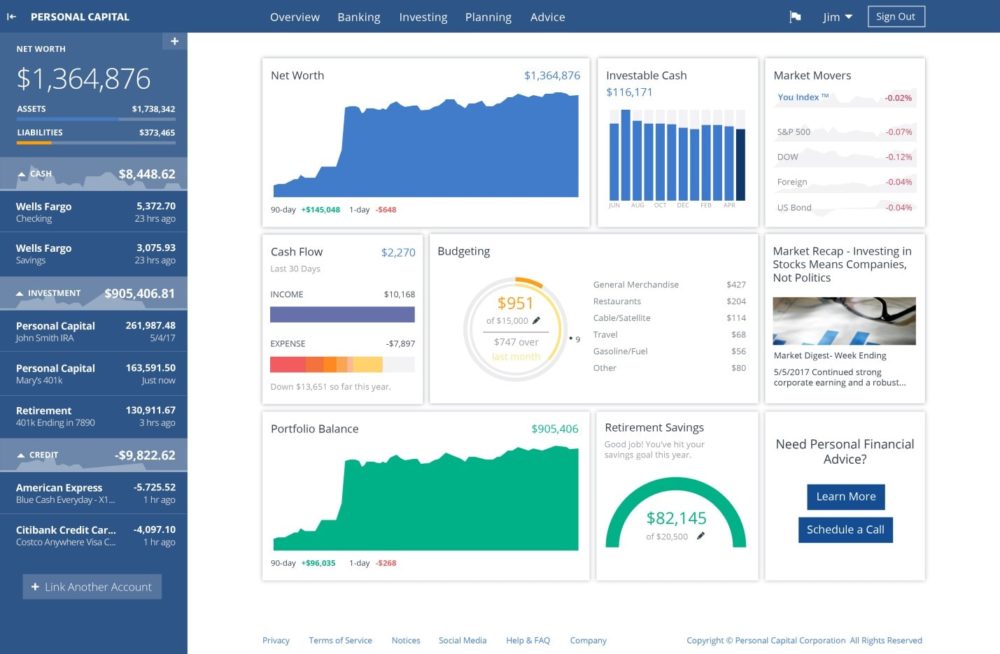

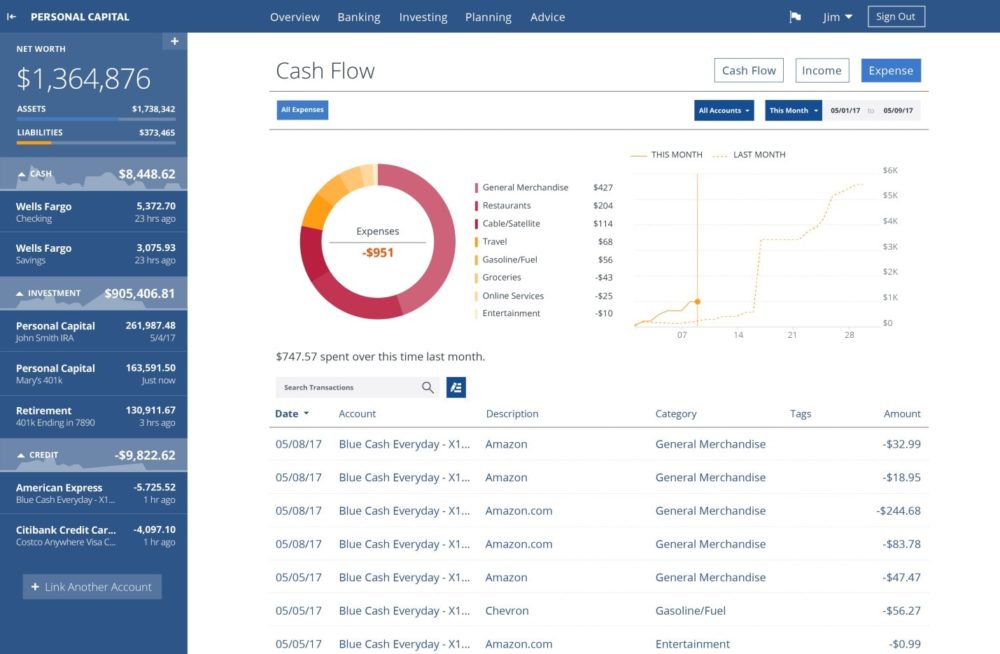

Below is what the homepage dashboard of the desktop version looks like. It shows you info like your current net worth (what you own minus what you owe), your monthly cash flow (income minus expenses), your investment portfolio balance, and how you are doing vs. the budget that you can set in the app.

Unfortunately, ^this $1.3m account you see in the picture above is sadly not mine… but with 20 more years of compound interest, who knows… 🙂

You can delve into any of the categories shown on the homepage in more detail. One of my favorites is the cash flow tracker.

The cash flow tab shows all of your expenses including purchases with your debit and credit card, as well as any income that you have from paychecks, dividends, etc. It’s an easy way to check exactly how much you are spending and how much you are bringing in or saving. Personal Capital does a pretty good job of categorizing your transactions, but every couple weeks I will go in and adjust the categories if it doesn’t quite understand what the expense is. That way I can see precisely how much I am spending on restaurants, utilities, entertainment, etc.

Why should I use Personal Capital?

To reiterate my preface to this article, you need to understand what your finances actually look like before you can optimize and improve your situation. The problem most of us have is that we don’t take this first step.

Many Americans live with an overly simplified view of their finances: If there is money in the checking account, spend it until it dwindles down. If the checking account is empty, either borrow on the credit card or wait until next paycheck to make the purchase.

However, if you are consistently tracking your income and spending, your entire mindset will change. You’ll be incentivized to improve because you won’t be able to push things out of sight and out of mind. When you want to go buy that new leather couch for $3,000, you’ll think twice.

Case in point: a couple months ago, I was thinking about buying a new Microsoft Surface Pro for $1,600. But I just couldn’t get myself to do it! The reason? I didn’t want to see my net worth drop by that much the next day when I opened up the Personal Capital app…

A couple of the major benefits:

- You’ll have increased awareness of your financial situation, enabling you to diagnose what you need to fix

- You’ll see how much you are spending each month, which is often very eye-opening

- You’ll be able to track the performance of your investments

- You’ll be able to see the balances of all your accounts without having to log on to multiple different sites

A word of caution

I do want to give one slight warning, though. Watching the performance of your investment accounts every day can be very dangerous if you don’t have self-control and the right mindset. As I mentioned in earlier articles, the markets go up and down over time. Volatility is not uncommon; it’s actually very, very normal. However, it can be extremely painful to watch the value of your investments go down.

That pain makes us behave irrationally. Your first instinct will always be to panic and to want to sell everything.

But please DON’T!

If you are buying high quality index funds, you should avoid the urge to sell as things are crashing and instead try to buy even more. From one of my favorite finance writers, Morgan Housel, “every past market crash looks like an opportunity, but every future market crash looks like a risk.” Next time the stock market is down 20%, 30%, or 40%, remember that.

This week’s action item

If you want to make the most informed decisions about your finances, you need data on how you are doing. Successful businesses look at tons of performance and financial data as they try to plan for the future, and so should you.

I can almost guarantee that if you start tracking your net worth on Personal Capital, your finances will immediately start to improve. It becomes sort of like a game to slowly and steadily try to raise that number up each and every month. It incentivizes you to spend less, to contribute to your investments, and to pay off your debts quickly.

Give it a try, and if you don’t see any benefit of using it, then just quit after a while.

If you would like to sign up, you can do so through this Personal Capital invitation link.

Full disclosure, if you use my link above and link an investment account, you and I should EACH receive a $20 sign up bonus. I love this product and would also promote it for free. So either use my link or don’t, but please do yourself a favor and get the app!

Happy tracking, my friends.