I remember in my high school trigonometry class we were allowed to bring one note card chock-full of notes to each exam. It was a complicated subject, and being able to write down a couple of hard-to-remember equations always proved to be a lifesaver.

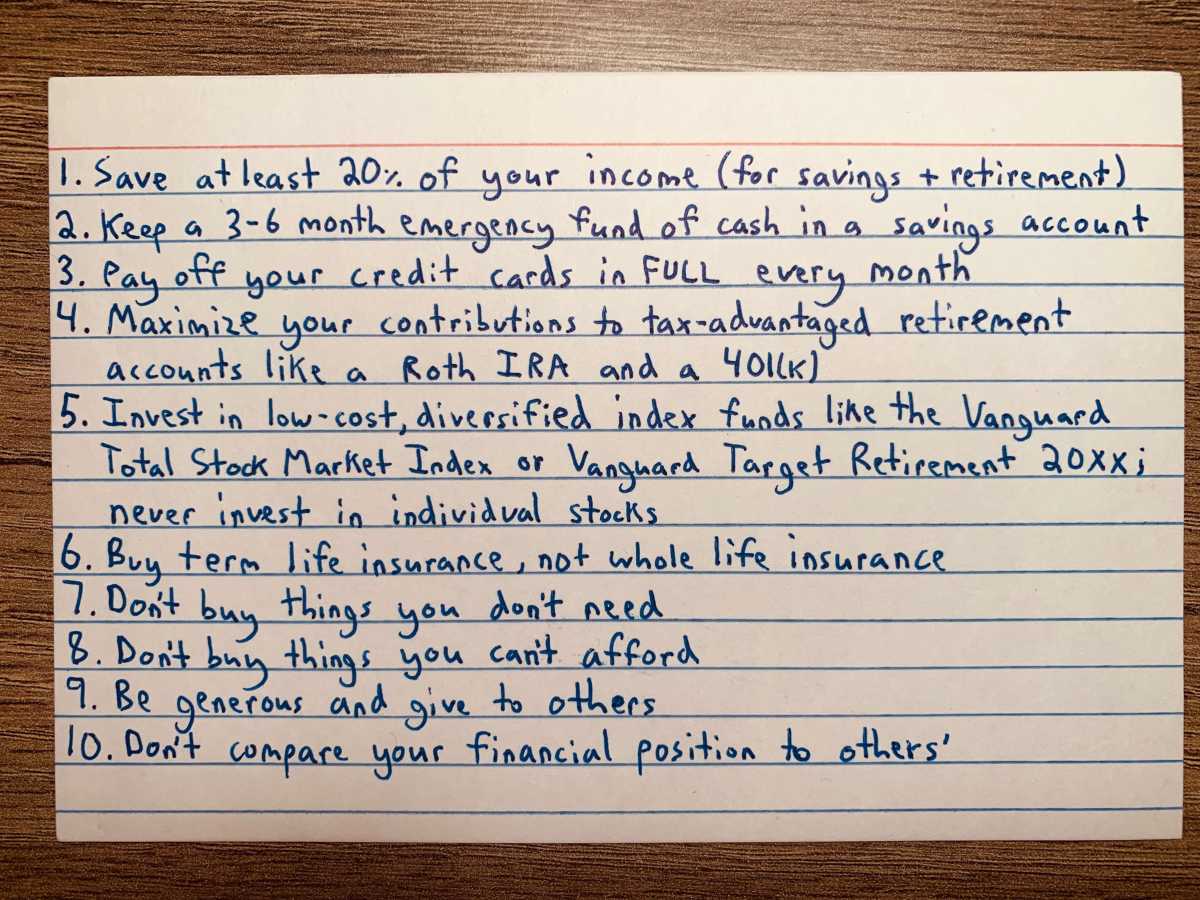

I wanted to do the same thing for personal finance—to create a simple, note card cheat sheet that would include the key points you need to remember.

Finances may seem as complicated as trigonometry at times, but it really doesn’t have to be. If you focus on the ten principles listed below, I think you’ll end up acing the money portion of this real-life test.

Tip #1: Save at least 20% of your income

Let’s face reality, folks… it will be nearly impossible to build any kind of wealth or freedom if you don’t save any money.

If you’re currently spending as much money as you make, you’re living in what I like to call the “financial hamster wheel.” You’ll be working forever to pay for your stuff and your lifestyle.

Focus on cutting down your spending or boosting your income until you are able to save at least 20%. If you are making $30k, that means aiming to save $6k this year. If you are making $60k, aim to save $12k. If you are making $120k, aim for $24k or more!

Don’t fall into the trap of inflating your spending to whatever your income level is (even though it’s so easy to do!). If you just graduated from college, keep living like a college student for a couple more years. If you get a raise or bonus at work, don’t blow it all in one weekend! Try to boost your savings rate instead.

Tip #2: Keep a 3-6 month emergency fund of cash in a savings account

One of the absolute first things you should aim to do when saving money is to establish an emergency fund. This is 3-6 months’ worth of expenses that you have sitting in your bank account. Do this before you even think about making a big purchase or investing! This needs to be numero uno!

Life happens. Medical bills come up. People lose their jobs. A roof starts leaking and needs to be repaired.

Having 3-6 months of expenses saved up buys you a little breathing room. You won’t be living paycheck to paycheck. If you get a bad break and are laid off from your job, it’ll provide you a bit of time to find the next one. Living without an emergency fund is like driving your car without a spare tire… everything is fine—until it’s not.

Tip #3: Pay off your credit cards in full every month

If you don’t keep an emergency fund as I suggested in tip 2, you’ll likely be forced to borrow money on your credit card when even small issues pop up. And that means you’re going to be paying interest. BIG INTEREST. Like 20% or something ridiculous.

I use my credit cards for every single purchase I make, but I make sure that I pay my balance off in full each month so that I’m not paying the exorbitant interest that credit card companies charge. If you treat your credit card like it’s a debit card and only buy things you can pay for when your bill is due, you’ll be okay!

Further reading: “Why You Should Avoid Credit Card Debt like the Plague“

Tip #4: Maximize your contributions to tax-advantaged retirement accounts like a Roth IRA and 401k

Once you have an emergency fund established, start saving for your retirement. To do so most efficiently, put money into retirement accounts including 401ks and Roth IRAs. You’ll end up saving a boatload of money in taxes and have more of it to enjoy when you’re older!

If you want to go more in depth and learn about why and how, you can always go back to read this other article I wrote on the topic.

Tip #5: Invest in low-cost, diversified index funds like the Vanguard Total Stock Market Index or Vanguard Target Retirement 20xx; never invest in individual stocks

In your retirement account, you need to be investing your money. Stocks have historically been one of the best performing asset classes over the last century, returning on average 7-10% per year. However, it’s very risky to buy stock in a single company. Even the best companies falter and can go bankrupt.

Case in point: General Electric.

Once the most valuable company in the world (valued at over $600B), it’s now worth only about $60B as we approach the end of 2018.

A wiser decision would be to invest in a diversified index fund like a Vanguard Total Stock Market Index (owns every single public company in the US) or a Vanguard Target Date Retirement Fund (owns a blend of international/US stocks and bonds). These funds charge very low fees and are very diversified. Consistently investing in these over the long run will likely make you very wealthy.

Further reading: “How to Invest“

Tip #6: Buy term life insurance, not whole life insurance

Insurance isn’t a topic I have mentioned in any article yet, but it’s something I think everyone needs be aware of. First off, let’s discuss why you should or shouldn’t buy life insurance.

You should buy life insurance if you are an income earner in your family and want to provide a replacement for that income for your loved ones in case you die. If your family would be in big financial trouble if you died, you definitely need to buy a life insurance policy that will provide them with a lump sum of money in the event of your death.

If you’re a single person with no dependents, there really isn’t anyone who should need any money if you died. So do yourself a favor and save some money by passing on the life insurance! However, if you expect to have a family at some point in the future, it can still be very wise to buy and lock in a long-term policy while you’re young.

If you do decide you are someone who needs life insurance to help protect your loved ones, don’t fall prey to insurance salesmen who are trying to sell you whole life insurance policies! They’ll blabber on about a “cash balance” and how great of an investment it is, but I can assure you it’s only a good investment for the insurance company…

Only buy term-life insurance. Term life insurance expires after 10, 20, 30 years, etc., rather than whole life insurance which goes on indefinitely. This means the monthly premiums you have to pay to buy term insurance can be substantially lower than whole life insurance.

If you take the amount you save each month and invest it in the index funds I listed in tip #5, you will come out way ahead!

Just remember, buy term insurance not whole.

Dave Ramsey agrees!:

Tip #7: Don’t buy things you don’t need

It’s amazing how easy it is to convince yourself you need something. Commercials, social media, and billboards are all bombarding us with advertisements every single day telling us that we need to buy something to make us happy.

You need a bigger house in the best neighborhood. You need a brand new car to impress your coworkers.

Really? Maybe the 1,500 square foot house is just fine. And maybe the 10 year old car that still runs well will keep doing the job for a couple more years. Every big lifestyle upgrade you make sets you back financially and keeps you on the proverbial “financial hamster wheel.”

On a day-to-day basis one of the easiest ways to avoid the temptation of buying things you don’t need is to avoid “going shopping.” When you go to the grocery store, make a list of things of what you want to buy and stick to your list! Never go when you’re hungry. We all know the disaster that ends up being…

And don’t visit the mall every single day/week! Only go when you actually need some replacement clothes. Browsing stores frequently (and seeing all the many, many things you don’t have) is a recipe for financial disaster.

And this goes for Amazon too!! Stop browsing Amazon Prime every night while you’re sitting on the couch watching TV.

Tip #8: Don’t buy things you can’t afford

Going into debt to buy something (besides a house) means you probably shouldn’t be buying it.

If you can only buy the new flat screen TV if you put it on a credit card, that’s a no go.

If you have to finance the new furniture for your living room, that’s a no go.

If you can only buy that new car because you took out a big auto loan, that’s also a no go (buy a cheaper, used option instead).

If buying a bigger house or moving into a fancier apartment across town is going to keep you from being able to save money, you need think long and hard about it. Can you really afford it if you can no longer save a little bit of money?

My answer would be probably not…

Tip #9: Be generous and give to others

We can all agree that a world full of selfish, miserly penny-pinchers would be a truly awful place. If you live in the United States and are reading this blog (even if you consider yourself poor), you are likely much better off than so many people around the world—and even in this country. It’s our responsibility to help those who are less fortunate, to give to causes we support, and to bless our friends and families with generosity. This means financially and also with your time.

It’s really easy to fall into the trap of thinking “once I get just a little more money, I’ll start giving.” Sorry folks, that’s usually not how it works. You see, it’s just human nature to want a little more. We just keep moving the goalposts.

Pew research did a survey a couple years back about how people define “rich.” It produced some very interesting results and illustrates this concept of “moving the goalposts.”

They found that people in households making less than $50k said you would need an income of $200k to be rich. People making $50k-$100k said you would need to make $260k to be rich. People making $100k+? Well, they said you would need to be making a half million a year or more!

Everyone always wants a little more, and most don’t think they have “enough.”

So, start being generous now, even if it’s a little difficult. You’ll be amazed how much joy it can bring to not only others, but to yourself.

Tip #10: Don’t compare your financial position to others’

What you can be sure of:

- Someone has a better job than you

- Someone has a nicer house than you

- Someone has a newer car than you

- Someone has more money than you

Don’t worry about others; focus on yourself! Try to improve yourself every single day and become the best person YOU can become. If you’re constantly comparing your situation to others you’ll end up trying to “keep up with the Joneses” and be depressed by how “little” you comparatively have.

Stop trying so hard to impress people and stop the habit of comparing yourself to your neighbor! Falling prey to that will keep you trapped for the rest of your life.

Be content. Be thankful. You’ll end up much more happy.

And that’s it, friends. Looks like you never have to read another one of my posts again—it’s all here. I’ve given away all my secrets!

Oh well… keep coming back anyway 🙂

This Post Has 2 Comments

Oh my gosh, this post was so helpful and insightful Josiah! I’m absolutely terrible with finances and this brought everything into perspective for me. This post was great 💯

Yes! I love hearing that people find some of them useful! Thanks Lauren!!