If you read the last article, you understand compound interest. And you understand that time is a very critical factor. But how does that actually translate into investing? Let me tell me one more story (don’t worry, not every post will not have one!).

Just for fun, let’s revisit our buddies, James and Fred, again.

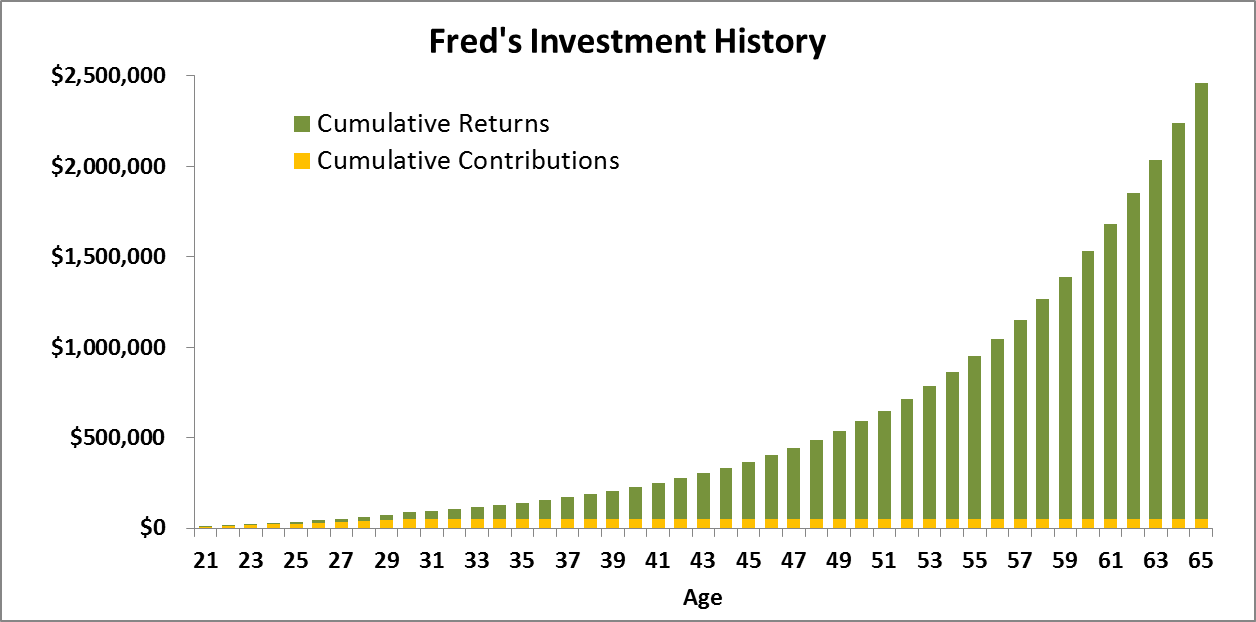

Fred decided to start investing in the stock market at age 20, by contributing $5,000 per year. (Historically the stock market has returned a little better than 10% per year on average over the last 100 years or so, so we will use that number as our estimated annual return). By age 30, he had contributed a total of $50,000 to his investments. He decided to never put another penny into his investments, because by that point he had a couple kids and needed to spend all of his extra money on them. With a 10% annual return, how much money do you think Fred had by the time he was 65 and wanted to retire? Believe it or not, Fred’s initial contributions grew into $2,463,342 by the time he quit his job! All because he contributed $50,000 in his 20s.

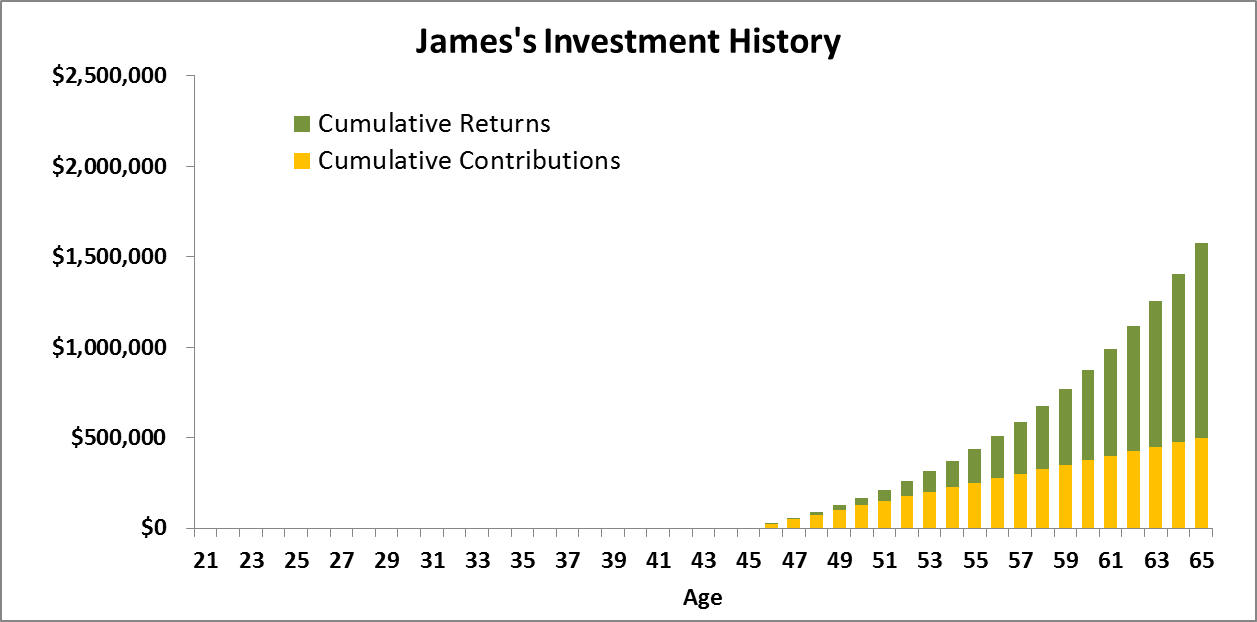

His older brother, James, still didn’t seem to learn the important role that time plays in compound interest. James didn’t get serious about investing until age 45, because it wasn’t until then that he felt like he had enough money saved up to be ready to invest. James realized he didn’t have any savings yet, so he knew he needed to step it up big time. He decided he wanted to contribute a large sum of $25,000 per year! This was fairly easy for him because he had finished paying back all of his student loans and was making big bucks working as a lawyer. James continued to invest $25,000 each year for the next 20 years as he saved for retirement at age 65. In total, he contributed $500,000 over that period, earning the same 10% annual return of his brother Fred.

Surely, James must have much more saved for retirement, correct? He contributed 10x as much money to his investments!

Well, you’d be wrong… James’ investments would have only grown to $1,575,062 by the time he turned 65… That’s $900,000 LESS THAN HIS YOUNGER BROTHER WILL BE RETIRING WITH!

Key takeaway from this story: START. ASAP. Even if it’s only $1,000 a year. Think from the perspective of your future self. Would you rather spend $1,500 on a top of the line college laptop, or buy a simpler $500 model and put the rest towards investments? If you resist the temptation to splurge, and instead invest your laptop savings at a 10% annual return, your 65 year old self would be $72,890 richer! All from the tiny, conscious decision to save and invest $1,000!

You may be sitting here thinking to yourself “this would have been great to know at age 20, but I am way too old for this to be of any benefit to me now…” Well, that may be true to some extent, but it’s never too late to take action. As they say, “The best time to plant a tree was 20 years ago. The second best time is now.”

Start saving and investing EARLY and OFTEN! Your future self will be glad you did!