The Best Place to Put Your Money while Saving for a Big Purchase

If you are in the market for a house or a car right now, no doubt about it – it’s tough out there. Home prices sit at record highs. Car values are also near record highs. Inflation has hit nearly

Is The Stock Market Crashing?

Don’t check your 401k statement right now. Don’t log into your Robinhood account. Don’t open up that IRA. I can tell you with pretty high confidence – you’re down. 2022 has not been a kind year to investors. Since the

Turbulent Times & Investing Lessons

It’s been over two years now since I wrote my last post. To say a lot has happened in the world would be an understatement. Let’s imagine that we went back to February 1st, 2020, and a magic genie gave

Investing in… Relationships

Maybe some of you have noticed that I haven’t written any articles recently. I’ll go as far as to you say you’ve probably had trouble sleeping at night just waiting in anticipation for the next FinanceIsFreedom post to come out…

What Can a Third-Grader Teach Us?

I got a text from my mom this week with a picture of something my little brother had typed up on his computer while he was at school. I was thoroughly impressed. Here’s what my young protégé wrote: Take Zach’s

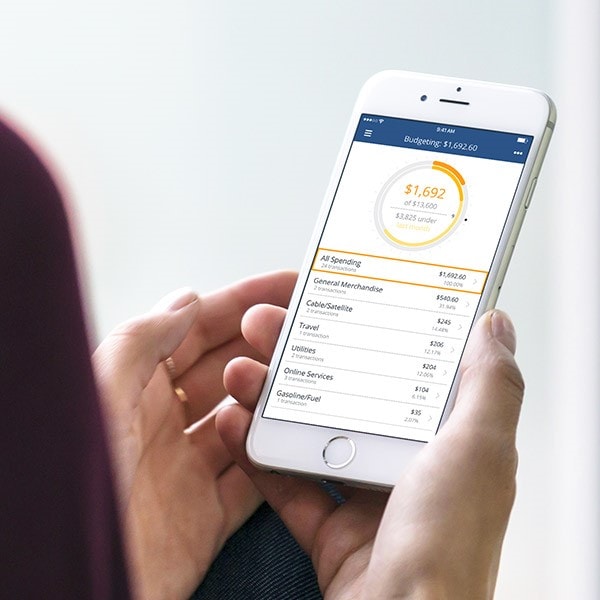

A Surefire Way to Improve Your Finances

Back when I was a teenager, I had to go through first aid training in order to become a lifeguard. One of the key areas of focus in the class was what to do when you come across someone who

All the Financial Advice You Need Fits on an Index Card

I remember in my high school trigonometry class we were allowed to bring one note card chock-full of notes to each exam. It was a complicated subject, and being able to write down a couple of hard-to-remember equations always proved

To Rent, or to Buy, That is the Question…

Buying a home. It’s a classic tenet of the American Dream. You grow up, get married, and buy that perfect suburban house with the white picket fence, yada, yada, yada… Have you ever heard someone say: “You need to buy

Your Guide to Retirement Savings

We have a retirement crisis on our hands in the United States. A recent survey indicated that 42% of Americans have less than $10,000 saved for retirement. This is a real problem. Let me give you some context. When the

Get Rich Slowly??

If you’ve been paying attention to the news this week, you’ve probably heard some talk about the lottery. Lottery fever is sweeping the country. Billboards, radio stations, news websites, and Twitter are all plastered with talk of the Mega Millions

You Might Want to Reconsider Buying that New Car

I currently drive a 15-year-old Toyota Camry. It comes with a foggy headlight, some peeling paint, and a six-disk CD changer that makes clicking noises every time I first turn on my car (that’s thanks to my little brother who

Why You Should Avoid Credit Card Debt like the Plague!

So, you’ve made up your mind that you want to start growing your wealth through investing? Perhaps you read this investing article and were convinced that you should be putting your money into a stock index fund so that you

Livin’ the Dream

Picture this: You’re 45 years old, married, with three kids. You live in the suburbs of Washington DC, in a beautiful 5,000 square foot house that you just built last year. It looks like a home straight out of HGTV,

How to Invest

Buying a stock is just like buying a lottery ticket I have been told. You pick a company and hope it goes up—rather than way down. And you always have to be afraid of those big market crashes where you

Become a Multimillionaire by Saving $5k per Year

If you read the last article, you understand compound interest. And you understand that time is a very critical factor. But how does that actually translate into investing? Let me tell me one more story (don’t worry, not every post

The 8th Wonder of the World

You might have heard the saying “wealthy people don’t work for money—their money works for them.” So what does that actually mean? Well, it means that wealthy people have money invested that earns a return and grows every year into