If you’ve been paying attention to the news this week, you’ve probably heard some talk about the lottery. Lottery fever is sweeping the country. Billboards, radio stations, news websites, and Twitter are all plastered with talk of the Mega Millions jackpot.

For good reason! The current jackpot stands at a mind-boggling $1.6 billion. That’s the highest jackpot in US lottery history. Dreams of instantaneously becoming a billionaire have captured the hearts and minds of millions of Americans across the country. Thousands and thousands of people are currently fantasizing about quitting their jobs, buying a private island, traveling the world, or buying a new house.

For fun, I decided to get in on the action this past Friday night by buying a couple tickets of my own.

I stopped in at a Wawa gas station with four $1 bills in my wallet and headed to the back of the store to find the lottery machine. I came around the corner to a line of at least 20 people who were doing the exact same thing! As I stood there waiting for about 15 or 20 minutes, the line never got shorter. It seemed like there was an endless supply of people showing up to feed their money into this machine for the chance to strike it big. I took my two tickets home and tuned in for the 11pm drawing to see if my first time playing the lottery was going to make me a billionaire.

So close.

Except for the part about getting the right numbers… I didn’t even match one. Oh well, looks like it’s back to normal life for me.

I found out the next morning that none of the other 280 million tickets that were sold on Friday were winners either. Now the jackpot will continue to swell until the next drawing on Tuesday. Let’s just say business is definitely booming for state lotteries!

Growing curious about the lottery, I did some research that I found to be pretty interesting. First, I discovered that the odds of winning the mega millions jackpot are currently 1 in 302 million.

To put that in perspective, your odds of getting struck by lightning during your life are 1 in 13,500. Your odds of getting killed by a shark are 1 in 3,748,067.

That means you’re 22,000 times more likely to get hit by lighting in your life or 80 times more likely to get killed by a shark than you are to win that Mega Millions jackpot.

Whelp, the math is not looking great for our lottery hopes. But that clearly isn’t enough to persuade people not to chase the dream.

I also learned that Americans spend about $80 billion per year on the lottery. That’s more than on movies, video games, music, sports tickets and books — combined. That’s an almost unbelievable $325 per year for every single adult in the United States.

The sad thing is the lottery is a losing proposition for almost everyone who participates. For every $1 spent on tickets, only $0.63 gets payed out in prizes. Local and state governments are keeping the other $0.37 to fund operations. And then prize winners pay another big chunk in taxes on their winnings! It’s effectively an ingenious way to get people to happily pay taxes to fund the government. The allure of striking it rich quickly will make people do irrational things.

I’m not trying to bash the lottery. The point of this article isn’t that you should never buy a lottery ticket (though doing it on a regular basis is without a doubt a really bad financial decision). So what’s the point?

Building wealth takes time.

The lottery is the ultimate example of instant gratification. It requires almost zero effort and zero time. But unfortunately, that’s not how most things in life work.

I hate to break it to you, but there’s no shortcut for building wealth and achieving financial independence. Unless you receive an inheritance or start a business that becomes really successful, it’s going to take commitment, self-control, and patience.

However, if you’re reading this and you’re under 30, I can almost guarantee you that you can become a millionaire during your lifetime. The formula is extremely simple. Spend at least 10-20% less than you earn every year and invest the difference in a diversified stock index fund. If you do this consistently, compound interest will do its magic and leave you very wealthy. It’s crazy powerful (read this article or this article if you missed them).

But it takes time.

You might have heard of a guy named Warren Buffett before. He’s one of the most famous investors of all time and is currently #3 on the Forbes billionaires list with a net worth of $86 billion. His investments in his company, Berkshire Hathaway, have snowballed every year into a bigger and bigger sum. What’s wild is that a remarkable 99% of Buffett’s net worth has been built after age 50. His investments took time to grow, but now his “snowball” has so much momentum coming down the hill that it cannot be stopped.

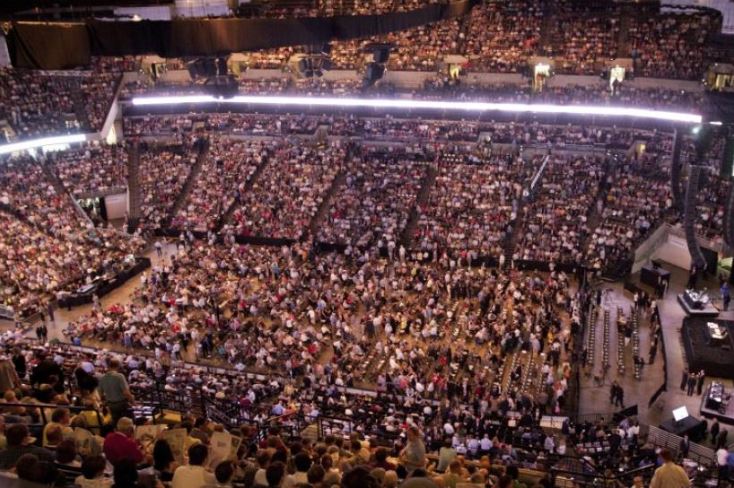

Buffett and his business partner Charlie Munger are world renowned for their wisdom, intellect, and investing skill. Every year, over 40,000 people show up to the annual Berkshire Hathaway shareholders meeting for the chance to listen to the duo speak and answer questions.

What many people don’t realize is that they used to have a third partner. 45 years ago they made investments with a guy named Rick Guerin. But then Rick fell off the map. He had been highly leveraged with margin loans (borrowing money to invest in stocks) right before a market crash in the 1970s. When the market collapsed, he had to sell everything to pay off all that he had borrowed. He even had to sell all of his Berkshire Hathaway stock to Warren Buffett for around $40 a share to come up with the cash.

If you weren’t aware, one share of Berkshire Hathaway now trades for $314,000.

OUCH. Talk about regrets.

Referring to the situation later, Warren said:

“Charlie and I always knew that we would become incredibly wealthy. We were not in a hurry to get wealthy; we knew it would happen. Rick was just as smart as us, but he was in a hurry.”

The Takeaway

Folks, you’re not going to get rich from the lottery. But you will over time from investments. Sadly, there aren’t any shortcuts to building wealth. You’re going to have to be principled and patient.

Stay away from penny stocks. Ignore the get rich quick schemes. And tune out those radio commercials telling you you can make millions flipping houses by simply attending a workshop and learning a “system”. If things sounds too good to be true, they probably are.

Get rich slowly.

Spend less than you earn and invest.

It’s not as glamorous as the lottery. But here the odds of winning are actually in your favor.

This Post Has 2 Comments

I appreciate this good financial advice

Glad you enjoyed it, Steven! Thanks for leaving a comment