Buying a stock is just like buying a lottery ticket I have been told. You pick a company and hope it goes up—rather than way down. And you always have to be afraid of those big market crashes where you could lose everything. You definitely shouldn’t own stocks, because it’s so risky. Who knows when the next Great Recession will come around and everyone will lose all of their hard earned money?

Wrong. I wholeheartedly disagree with all of these commons myths.

The US stock market has been an incredible generator of wealth over the last century and I believe will continue to be in our lifetimes as well. Stocks really aren’t as scary as some may lead you to believe. Let me address a couple of these concerns.

Myth 1: Stocks are too risky. What if my company goes bankrupt?

Yes, buying a single stock is inherently risky and if the company falls into financial ruin you could lose everything. But buying one stock is never what I think anyone should do. I recommend buying an index fund.

So, what’s an index fund?

An index fund is an investment you can purchase that invests in many companies (hundreds to thousands) rather than one. This cuts down drastically on the amount of risk you face, because all of your returns are not based on the fate of a single company! Let’s look at my two favorites: the Vanguard S&P 500 Index (VOO) and the Vanguard Total Stock Market Index (VTI).

The Vanguard 500 index makes you an owner of pieces of the 500 biggest US companies. Think Google, Amazon, Netflix, McDonalds, Apple, Nike, etc. By buying VTI, you are buying a small piece of each of the biggest and best companies America has to offer.

However, there are also many smaller companies that don’t earn the distinction of being one of the 500 biggest. Buying the Vanguard Total Market Index lets you also buy a stake in all of these smaller companies as well. It literally owns a piece of every single public company in the US. As of this writing, that was 3,654 companies! These indexes are weighted based on the size of the companies. So for example, Apple, the most valuable company in the country, gets allocated the highest percentage of the index. As you go down the list of smaller and smaller companies, they begin to make up smaller percentages.

This is the ultimate diversification. Who cares if one company goes bankrupt! You won’t even notice. Buying an index fund is an investment in the American economy. As our economy grows, businesses make more and more money over time, and you as an owner get to share in the profits.

Since its inception 42 years ago in 1976, the Vanguard S&P 500 index has averaged an 11.04% annual return. This return would double your money in fewer than 7 years on average. The Vanguard Total Market Index has returned 9.7% annually since 1992. Not bad. Check out the previous article if you want to see just what these kinds of returns can do.

Myth 2: We are going to have another recession again and the market will crash and I will lose all of my money.

Now, don’t get me wrong. I’m not saying we aren’t going to have another recession. In fact, I GUARANTEE you that we will see another recession sometime. Could be next year, could be next decade—no one knows. What I am saying is that it doesn’t mean you will lose all of your money.

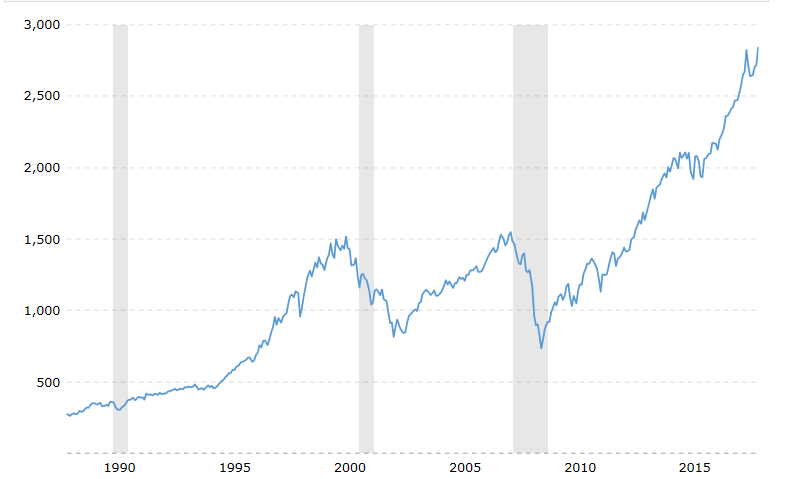

Look at this price chart below of the S&P 500 over the last 30 years. The grey bars indicate where our economy has been in a recession. If you look at 2008 and 2009, you’ll see the great financial crisis. Many people’s investment portfolios were cut in half. It truly was a scary time to be an investor.

But… if you would have held on to your investments and not panicked and sold them as the market was plummeting, your investments would have recovered back to peak levels within ~3 years.

This is also not factoring in the dividend payments that your stocks would have been paying to you each year. If you would have reinvested your dividend payments into more shares during the market crash, or even better yet, contributed more money to your investments, you would have come out ahead even faster!

For a young person, a stock market crash can be a great opportunity. It’s the perfect time for you to buy as many shares as you can at bargain prices! As the saying goes, “the stock market is the only market where things go on sale and people run out of the store.”

If you don’t remember anything else from this post, let it be this: buy a well-diversified index fund and buy more of it every year. If the market is going down, buy even more! The US stock market has recovered from every single crash it has ever gone through and continued to rise to new heights, building wealth for its owners. Why would the next time be any different?