Don’t check your 401k statement right now. Don’t log into your Robinhood account. Don’t open up that IRA.

I can tell you with pretty high confidence – you’re down.

2022 has not been a kind year to investors.

Since the start of the year, the S&P 500 has fallen over 17%.

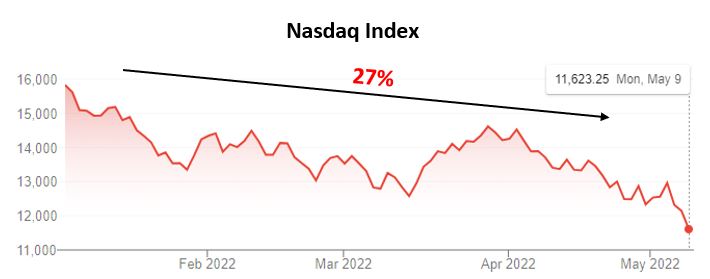

The Nasdaq (an index of technology companies) is down 27%.

If you bought individual stocks that soared during the pandemic, you’re probably feeling even worse. Take a look how far these pandemic darlings have fallen from their peak:

Zoom – down 83%

Peloton – down 91%

Zillow– down 82%

Wayfair – down 81%

There are a lot of bad things happening out there in the economy right now.

Inflation is increasing at the fastest pace since 1981. Mortgage rates have skyrocketed in the past few months, creating even more home affordability woes. China, our largest supplier of goods, is currently facing extended COVID lockdowns and production delays. The war between Russia and Ukraine is still raging.

There are a lot of things to be worried about. Our future economic growth looks shaky.

So, what to do?

One of my favorite personal finance writers, Morgan Housel, has a really smart saying that rings out in my head whenever markets are going down:

Whenever we look at a stock chart, we think “oh man, if only I could have bought in at those insanely cheap prices when the market crashed in 2009 or 2018 or 2020” (we do the same with house prices).

What we forget is that during each of those times, people were worried. Everyone thought stocks were headed even further down. Many bad things seemed to be happening. The economic environment was extremely unstable.

However, as often happens in moments of extreme pessimism, the clouds part. Fears of economic collapse fail to materialize. And the markets continue their steady march to new highs.

The volatility is part of the game. As the saying goes: “No risk, no reward.”

Do I know if the market will keep going down another 10% or 20%?

Absolutely not. No one does.

But what I do know is that I’m going to keep buying stock index funds each and every month, whether the market is going up or down.

♪♪ Just keep buying. Just keep buying. ♪♪ (to the tune of Dory in the movie Finding Nemo).

If you are investing for goals that are at least 5 years away, I’d encourage you to forget the day-to-day noise and do the same.

This little downturn will probably look like a buying opportunity come 2027 and a blip by 2032.

P.S. If you would like to read more wisdom from Morgan Housel, he has written a great book called The Psychology of Money: Timeless lessons on wealth, greed and happiness. Highly recommend.

He also writes a really great blog at The Collaborative Fund.