If you are in the market for a house or a car right now, no doubt about it – it’s tough out there. Home prices sit at record highs. Car values are also near record highs. Inflation has hit nearly every part of the economy.

Saving up for a big purchase can seem more daunting than ever.

I’ve been asked a couple of times recently:

“I’m trying to save up for a down payment so I can buy a house next year. Where should I put the money? Should I have it invested or just save it in a bank account?”

It’s a really valid question.

The Problem with Savings Accounts

Currently (in July 2022), the national average savings account interest rate is a whopping 0.08%. For every $1,000 kept in a savings account, the bank is paying 80 cents of interest per year…

That’s insulting.

Saving money in most savings account earns you practically nothing.

But that’s not the worst part…

The latest Consumer Price Index report that came out for June 2022, showed that prices of goods and services rose by 9.1% over the past year. This inflation means that most of the things you buy cost significantly more than they did last year. Your money doesn’t go as far.

Saving money in a savings account actually gives you reduced purchasing power each year, due to inflation.

Savers are in quite the pickle. This would certainly make the case for investing the money you are saving up so it can grow faster, right?

The Problem with Investments

Unfortunately, this option comes with some big problems too.

For one, let’s assume the best scenario: your investments make money. For any gains you make on your investments, you will likely have to pay taxes (since these investments would not be in a tax-free retirement account like a 401k or IRA).

This makes your tax filing a bit more complicated and will likely take 10-40% of the gains you made. Uncle Sam always likes a cut of your profits.

However, the much bigger problem is that investing, especially in the stock market, is very volatile.

The stock market goes up over the long run, but in the short term it can drop, decline, or even crash for any number of reasons.

Keeping your short term savings in most investments is very risky.

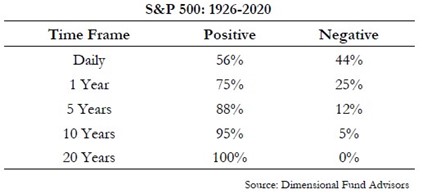

Look at this chart below that shows how often an investment in the S&P 500 during the past ~100 years would have been positive or negative depending on your investment time horizon.

The data show that if you only invest in the S&P 500 for one day, your odds of making money are about the same as a coin flip. However, if you would have invested for 20-years, the stock market made you money 100% of the time.

Currently, we’re in a downturn.

The stock market (VTI: Vanguard Total Stock Market Index) is down about 22% in 2022. The bond market (VBTLX: Vanguard Total Bond Market Index) is also down 11%.

If you had been investing your savings for the past year with the expectation that you would use the money in the summer of 2022 to buy a house, you would now have significantly less money than you expected. This could mean you may need to keep saving multiple months longer than you originally planned!

That scenario could be devastating if your dream house came available, but you were now short on funds because of the decline in the market.

What do I recommend?

In my opinion, the volatility of investing makes it a no-go for any short-term savings goals.

I suggest you park your money in a *high yield savings account*.

There are a number of them out there, but Ally Bank and Capital One are a couple good ones I am familiar with and would recommend.

They currently pay about 1% in interest.

It’s not much to write home about, but it’s better than the national average of 0.07%!

Quick tip: banks that are predominantly online like Ally and Capital One usually pay way better interest rates than the big banks with lots of branches like Wells Fargo, Bank of America, and Chase.

Try to look up the rate you may be earning at your bank by looking at your Account Info section or even by Googleing it.

Summary

Based on the risk/return of investing vs. saving, I would boil it down this. If your goal is:

Within 1 year: No brainer, use a savings account

1-3 years away: still best to use a savings account

3-5 years away: it depends. This time range is tricky. You could do a split between savings account/investment account, or could invest in stable short-term investments like a Certificate of Deposit.

5+ years away: use a stock market investment account

So, for all of you out there saving up for a near-term purchase of a car, house, or big vacation, my final advice is don’t worry about maximizing your returns or fret that you are losing a bit to inflation.

A savings account (even if it isn’t a high yield savings account), is still probably the best place to stack that cash.

The future is very unpredictable.

The dependability, accessibility, and simplicity that a savings account offers can provide provide significant peace of mind and optionality when you go to make that big purchase.