Buying a home. It’s a classic tenet of the American Dream. You grow up, get married, and buy that perfect suburban house with the white picket fence, yada, yada, yada…

Have you ever heard someone say:

- “You need to buy a house so you can stop throwing your money away on rent.”

- “We bought this house for $100k back in 1975 and just sold it for $450k this year! What a great investment!”

- “I can get a mortgage for the same amount that I can rent this place for. Why would I ever keep renting?”

There’s something most people find alluring about buying a house. The place is yours—you can paint the walls if you get tired of the color, build a deck for having big cookouts, or renovate that old master bath. You don’t have to worry about a landlord raising rents next year or even kicking you out when your lease is up. It’s stable. It can signify to others that you’ve “made it” financially. It has the ability to go up in value over time.

But is owning a home really all it’s cracked up to be? Do I need to own a home to be financially successful?

In the rest of this article, I’ll try to use some math and some logic to compel you to think a little more carefully about buying vs. renting your primary residence. I’ll try to debunk some of the common sayings listed earlier to prove why buying and renting both can be the better decision depending on your situation. (Note: this is not a discussion on real estate investing—that’s a whole different topic!)

I certainly don’t want you rush into to something that will end up being one of the biggest financial decisions of your life without being well-informed.

Before you head out to your next open house, read the rest of this!

1. “You need to buy a house so you can stop throwing your money away on rent”

This myth kinda makes sense, right? Every dollar of rent you pay goes straight to your landlord’s pockets. However, when you’re paying a mortgage, you’re paying down your debt balance and increasing your equity (the amount of the house you own).

This is all true, but it’s not quite as great as it’s cracked up to be. This is because your mortgage payment also includes taxes, insurance, and the real killer… interest. To make it worse, your loan is amortized, which essentially means that you pay most of your interest upfront and so the majority of your initial payments are primarily interest!

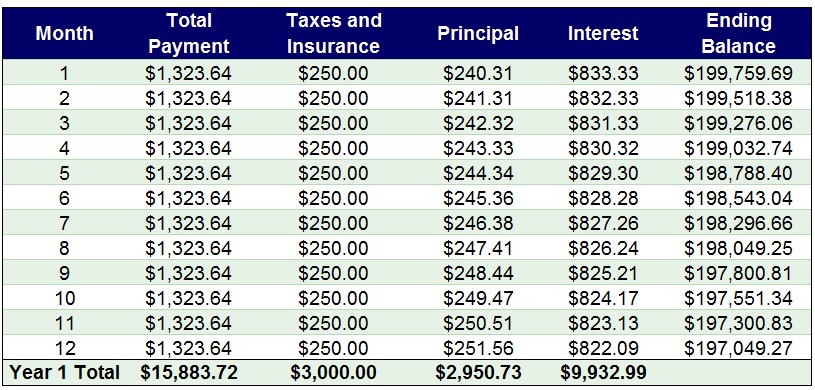

Let’s look at an example of Homeowner Hank:

He recently bought a house for $250k. His down payment was 20%, or $50k. He was left with a $200k loan at 5% interest. Let’s assume his annual property taxes will be $2k and his homeowners insurance will be $1k.

I ran these through a handy dandy online calculator, and found that his monthly payment will be $1,323.

Guess how much of that is going to pay down his loan balance in the first month?

Less than $250. The rest is going to paying his interest, taxes, and insurance!

He’s definitely not building $1,323 in equity each month. See how that monthly principal payment is increasing ever so slightly each month while interest is decreasing? Well, it’s not until year 16 when more of his payment starts actually going to principal rather than interest.

If he gets a 15-year loan, he can accelerate this interest pay down quite substantially, but then he also has a much larger total payment. It still takes about midway through the life of the loan until he would be paying more principal than interest.

So next time you hear someone tell you you’re throwing away money on rent, you can let them know that they’re throwing quite a bit away on their mortgage too!

2. “We bought this house for $100k back in 1975 and just sold it for $450k in 2018! What a great investment”

Wow, who wouldn’t want to do that? Sounds like a pretty good deal to me. But when you actually dig into the numbers a little bit you won’t be so impressed.

The lurking problem is inflation. Inflation is when we have an increase in prices and therefore a decline in the purchasing power of money. This year it costs $10 to buy a movie ticket, next year it costs $11. Last year your rent was $1200, this year it’s going up to $1250, etc.

The reason I picked the example of home prices above? That’s simply the impact of inflation since 1975. $100k in 1975 has the same purchasing power as $450k in 2018! Back in 1975, a new car cost $3,800, a postage stamp was $0.13 and a year at a private college cost $3,700.

Your $100k house in 1975 would cost roughly $450k in 2018 dollars. This is the result of inflation going up about 3.6% per year since 1975. If you stuck $1 under your mattress back in $1975, you would be extremely disappointed with how little it would buy you today!

I looked at the S&P/Case-Shiller US National Home Price Index which shows how home prices have performed on average across the country over the last thirty years. Guess what the average annual return has been over that three-decade period for housing?

More often than not, when you get excited about your home price rising, you are essentially just getting excited that inflation has been going up.

Don’t get me wrong. If you cherry pick locations and dates, you can get much, much better returns than inflation. Maybe you were smart enough (lucky enough) to buy your house in in San Francisco or Las Vegas during the recession. But for most of America, you should simply expect the price of your house to rise with inflation.

Nothing wrong with that! A 3% return is certainly better than nothing. But should a house really be your biggest investment, as so many people love to say?

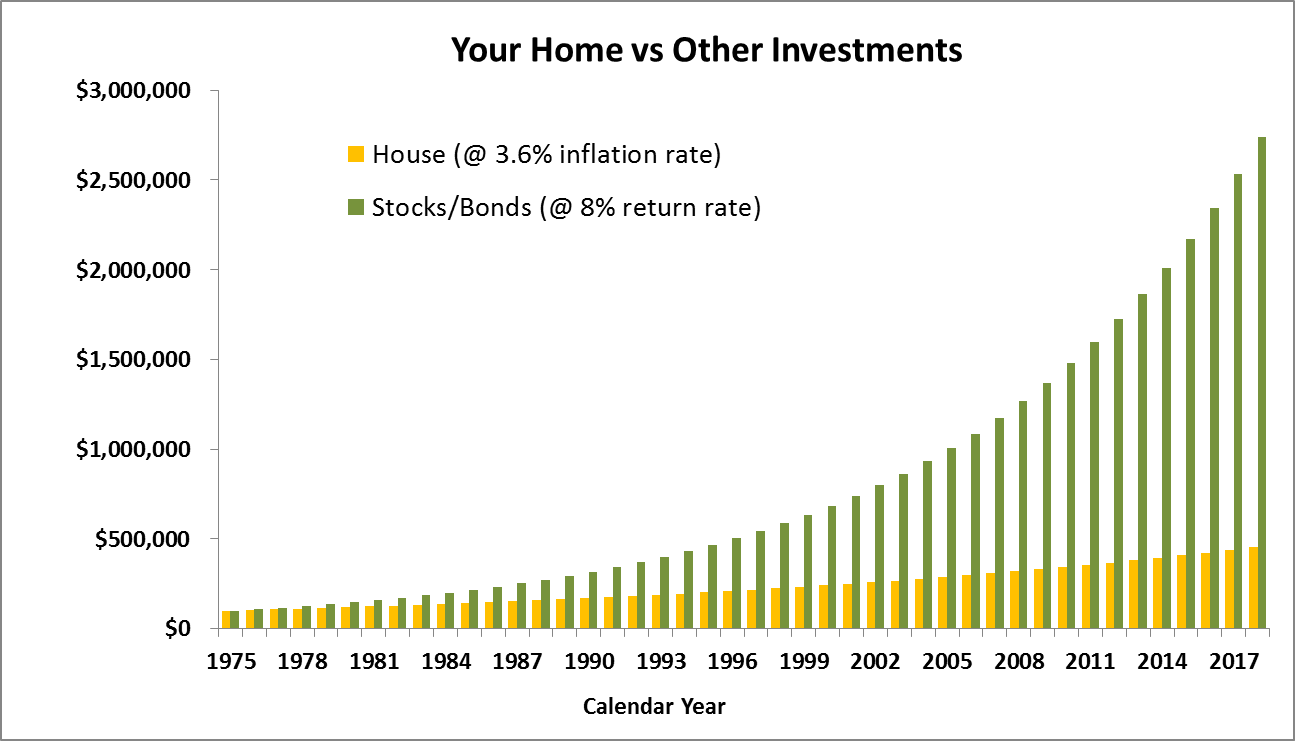

Look at this chart below that shows if you would have taken your $100k in 1975 and invested it in stocks/bonds earning 8% instead of a house tracking a 3.6% inflation rate. Your house would have risen in value to $450k, but an investment portfolio would have risen to $2.7M.

The $450k doesn’t sound so impressive anymore.

I get it—you need to have somewhere to live. You can’t live in a stock portfolio!

Point taken. I’m simply trying to get you thinking about the fact that a primary residence shouldn’t really be considered a great investment.

By making a sizable down payment on a house, you are tying up your capital in a low-performing asset for a long period of time. That’s a big sacrifice.

3. “I can get a mortgage for the same amount that I can rent this place for. Why would I ever keep renting?”

If only homeownership was that simple.

What happens when your roof is leaking? Your hot water heater stops working? You need to replace the rotting siding?

All of these costs go above and beyond the normal monthly mortgage payment. And they can end up costing thousands of dollars each year. You might be perfectly fine for 6 months without any repairs to make, but then all of the sudden you have to shell out $5k to replace the HVAC system. When you’re a homeowner you always need to try to keep an emergency fund on hand for these big expenses.

Additionally, does this mortgage payment you are eyeing include taxes and insurance? Because you certainly need it make sure it does. Taxes and insurance will cost at least a couple thousand dollars every year. Even once you pay off the mortgage these fees continue!

What I am trying to say is: Do not budget for owning a house by simply looking at your monthly payment.

So when should I rent and when should I buy?

This is a very complicated question with a number of factors, but let’s highlight two of the most important considerations.

Factor 1: How long do you plan to live there?

One of the biggest factors in this decision is how long you plan to live in a place. If you are going to live somewhere for 30 years, it definitely makes the most sense to buy your house. If you are going to be living somewhere 1 year, renting almost always wins.

Why?

One big reason is closing costs. When you buy house or you sell a house, you have to pay all kinds of fees. Think realtors, title agents, loan officers, transfer taxes, and so on. As a general rule of thumb, when you buy, these can add up to 2-5% of the purchase price and when you sell it can be another 6-8%. Let’s say you buy a $200k house, but then decide you need to sell it. You’ll likely be facing $20k of fees out of your pocket just from buying and selling! You better make sure you live in the property for a number of years and hope that prices are steadily moving up in your area!

If prices drop 10-20% in a year, it could be a very painful selling process. Worst case scenario, you might actually owe more on your mortgage than your house sells for and you have to pay money to the bank when you sell.

I’m not trying to scare anyone, but rather just make you aware of a possible outcome. It happened all too frequently in the last recession.

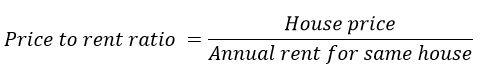

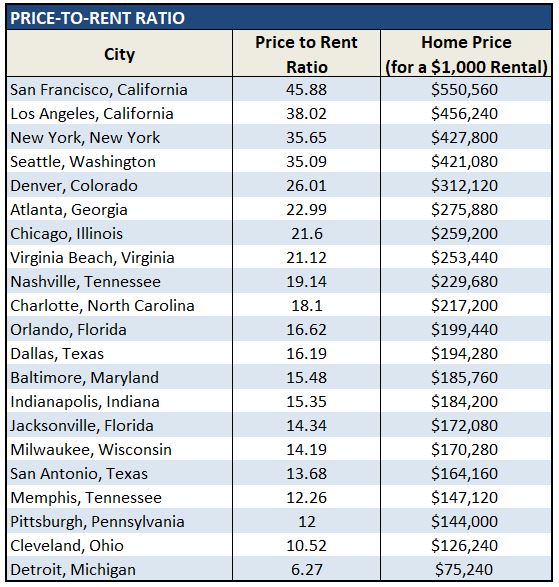

Factor 2: What is the Price to Rent ratio in your area? Or, said another way, are houses more expensive to rent or buy where I am?

So what exactly is this Price to Rent Ratio?

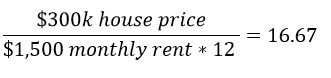

For example:

In some places you can rent a house for $1,500 per month that would sell for $200,000. This would be an 11.1 P/R ratio. In other places a $1,500 per month rental might sell for $400,000, a 22.2 P/R ratio. A high P/R ratio signifies it is more favorable to be a renter and a low P/R ratio signifies it is better to be a buyer.

A very general rule of thumb:

- Below 15: the market is probably more favorable for buying than renting

- 15-20: the market doesn’t strongly favor buying or renting

- Above 20: the market is more favorable for renting than buying

Here’s a list below that shows some average ratios for current metros across the country.

Notice how expensive it can comparatively be to buy a house in a big coastal city! These markets might have better potential for values rising in the future than some of the others, but remember what we learned about your home usually not being a great investment…

Go on to zillow.com and look up what comparable places are both renting and selling for in your area, and try to do this calc for yourself.

Action item:

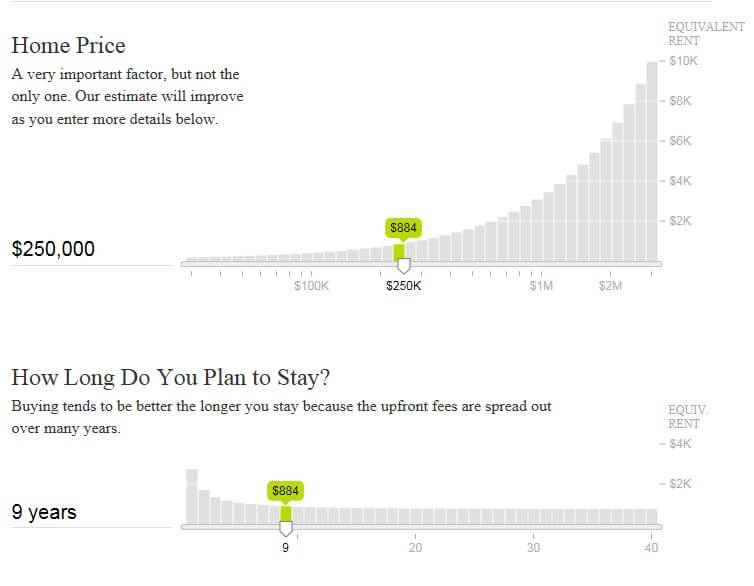

The New York Times has a really good online calculator that you can use if you are interested in running the rent vs. buy numbers for your specific situation. Simply select the answers to the variables that it asks for and it will provide you with a good overview of whether it may make more financial sense to rent or buy for you individually. Here is a screenshot of what it looks like:

Do yourself a favor and run the numbers after you finish this article! It can be very eye-opening.

Bottom Line

I understand that buying a house is usually not solely a financial decision. There are, of course, many non-financial considerations that go into the decision—like wanting the freedom to do what you want to the house or stability from not being at the mercy of a landlord. You may simply want to find the ideal place with the big yard where you can live for 20 years to raise your children.

However, renting also has a number of benefits—you can move to a new city or part of town with much less hassle, and you get peace of mind from not being on the hook for home repairs and maintenance when things inevitably break down.

What you really need to consider is what stage of life you are in and what kind of a lifestyle you want to live. Which of the above scenarios do you value more? I think it’s a shame that many people who are unprepared get persuaded into buying a house simply because of preconceived notions of the financial benefits. Owning a home is a big expense and does not provide very good long-term returns. It shouldn’t be viewed as a retirement plan or a path to riches.

If you can afford a house and want the lifestyle, then go ahead and buy. If not, then just keep renting—and don’t feel guilty doing so.

This Post Has 2 Comments

You have laid out beautifully the pros and cons to buying a house. I enjoy reading your blogs Josiah. Keep up the good work!

Paul Wilson

Thanks for the kind words, Paul!