So, you’ve made up your mind that you want to start growing your wealth through investing? Perhaps you read this investing article and were convinced that you should be putting your money into a stock index fund so that you can retire a millionaire.

Fantastic. That would, without a doubt, be a great step forward towards improving your financial position.

But before you pat yourself on the back too much, let’s just pause for a second. Because there’s something you might not be aware of right now that could be making you take two GIANT steps back. It’s slowly pulling you back towards mediocrity, towards living paycheck to paycheck, and towards never achieving financial independence.

It’s not much of a mystery since I kind of already gave it away in the title. Yes, the shackle that’s holding you back from freedom is credit card debt.

Good ol’ credit card debt—we all know it’s probably something we shouldn’t have, but, boy, is it ever convenient and easy to get. You can make thousands of dollars’ worth of purchases in a month, all for the simple low payment of maybe $100, $50, or even $25 a month!

Buy now, pay later!

While it certainly sounds much nicer to make monthly payments of $50 rather than having to spend $1,000 upfront, you might want to think twice.

It’s. A. Trap!

Why? Because credit card companies charge outlandish amounts of interest for this convenience of being able to pay later. Most credit cards charge you 15-20% annually in interest on any balance you carry to the next month! To put this in perspective, most mortgages nowadays charge around 4 or 5% interest.

If this doesn’t scare you, go read this article again to see the power of a 10% interest rate over time. But unlike that situation, you’re not earning interest from investing, you’re the one now paying it.

So, think about. Even if you have money invested in the stock market earning 10%, but you have a credit card balance where you’re being charged 20%, you’re losing ground.

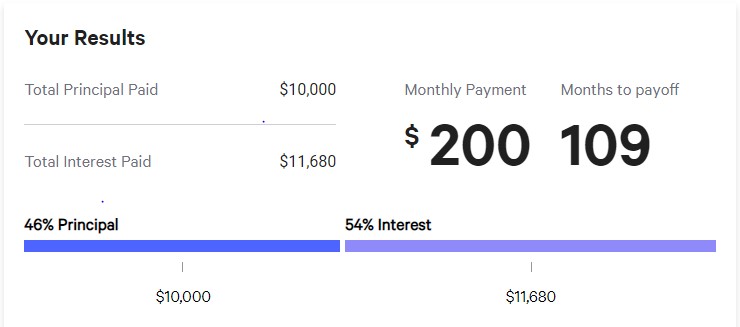

Say you have $10,000 in credit card debt currently, and you’re being charged a 20% rate. (This is very common situation for many, many Americans). Typically, a credit card company would let you make a minimum payment of around 2% of your total balance, so in this case, $200. Let’s play out the result…

I used a simple calculator on Bankrate.com. It shows how long it would take to pay off this debt and how much the total cost would be. I ran the numbers for us below.

By only paying the $200 minimum, you would have to make payments for 9 YEARS and would end up paying over $21,500 total for that one balance.

Now think about how much it would cost you over your lifetime if you made a habit of this!

So, what to do?

- Don’t buy things you can’t afford

Credit cards make it easy to spend above your means. Treat your credit card like it’s a debit card, and only buy something if you actually have the money in your bank account to pay for it. Don’t use a credit card as a way to buy things you otherwise wouldn’t be able to. That’s a recipe for disaster and a surefire way to accumulate a balance very quickly.

- Pay your balance off in full each month.

As long as you’re paying your full balance each month, the credit card company can’t charge you any interest! As simple as that.

You’ll actually make money from your credit card company due to travel and cash back rewards! You can literally make hundreds of dollars per year from these rewards. Guess who’s paying for all that cashback and those airline miles? The people who keep a balance and are paying the crazy interest!

- If you currently have a balance, work as hard as you can to pay it down to $0.

Credit card debt is one of the highest interest rate loans you can get. That means it’s doing a great job of preventing you from growing your net worth. Do everything you can to pay it down as fast as possible, so that you can then get on the path to following step #2. Throw any extra cash you can at the loan each month. Whether you have to pick up a side job, go out to restaurants less, or avoid the mall for a while, make it a goal to get rid of your balance ASAP.

If you have multiple credit cards with balances, I’d recommend trying to pay off the one with the highest rate first. Or, you could also just attack the one with the smallest balance first, pay that off, and move on to the next one. While that mathematically isn’t the most efficient, it helps build a sense of accomplishment that can be really motivating as you knock out your debts one by one.

Whichever one you choose, remember:

Takeaway of the day: Be smart with your credit card spending and habits! Next time you’re tempted to not pay off your full balance at the end of the month, think about how badly the credit card company will be robbing you… and how much you’re therefore robbing your future self!