I currently drive a 15-year-old Toyota Camry. It comes with a foggy headlight, some peeling paint, and a six-disk CD changer that makes clicking noises every time I first turn on my car (that’s thanks to my little brother who jammed the thing by shoving coins down into it when he was 3 or 4).

This Camry is super sexy. It catches eyes as I drive past and signals status, success, and wealth. HAHA, NOTTTTTT…

Do I want a new car? Sure.

Could I afford a new car? Sure.

Am I planning to buy a new car any time soon? No way, Jose!

What’s the big deal about cars?

Perhaps you’ve thought to yourself, “If only I could cut out my $5 latte habit, I’d be able to save so much more money!” By all means, please go ahead and do that, because it’s true. But that could be small potatoes compared to what you could be saving in some other areas of your life.

According to the US Bureau of Labor Statistics, the two biggest expenses for the average US household are housing and transportation. Roughly $10,000 per year is spent on transportation related expenses alone. Given that, it makes sense that cutting your car expense will likely help out your budget way more than eliminating that Starbucks visit every couple of days.

One of the single biggest ways I think you can save more money and boost your financial position is by driving an older vehicle.

Three reasons I don’t like new cars

1. New cars come with ridiculous price tags

The average new car sold in 2018 costs over $35k. Just think about how many months you’d have to work to make $35k… For the median US wage earner, that would be ¾ to a whole year of after-tax paychecks. I, for one, certainly don’t want to spend months and months of my life working for something that I rarely use for more than 1 hour per day.

2. New cars come with big loans

Since most people don’t casually have $35k of available cash lying around, that means you’d probably have to borrow the money. The average new loan for a car in 2018 is $31k, with a term of 5 to 6 years. That’s a lot of monthly payments you’ll be making. And while the interest rates are usually much better than for credit card debt (check out my article on that), you’re still forking over a lot of extra money to your lender each month in the form of interest payments. When all is said and done, you’ll likely have paid more than $40k for that $35k car you bought once you factor in the interest.

3. New cars lose value insanely fast

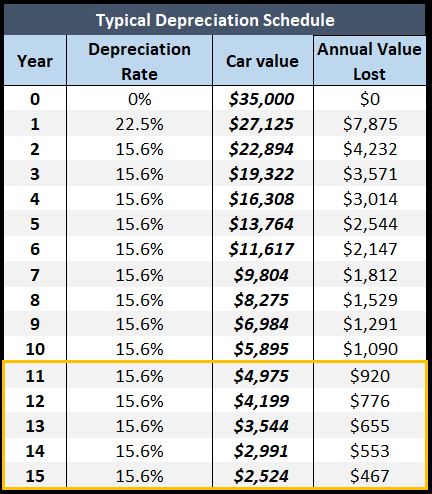

Now this is the real kicker. The issue with buying a brand new car using a loan: depreciation. The first time you drive the car off the lot it immediately loses 10% of its value. By the end of the first year, it drops another 10% or so. By the time you get to the five-year mark with your new car, it will have depreciated by about 60%, on average. To make the numbers a little more real, that beautiful $35k car of your dreams — that you have so faithfully made $40k worth of monthly payments for — is now worth less than $14k.

Imagine if it worked the same way with houses. You move into your new $200k house, and the first day the value drops 10% to $180k. By the end of year 1, it falls another 10% to $162k. By the end of year 5, it’s worth $80k. That would be insane! But it’s what we do on a smaller scale with cars year after year.

So what should I do?

Warning: this may sound stingy, miserly, and preachy, but just hear me out.

1. Buy a practical, used car

Rather than buy that $35k average new car that we’ve been talking about, simply wait until it’s 5 years old and buy it for $14k. If we assume that you use it for the next 5 years (so until it’s 10 years old), its value will have likely fallen to around $6k by year 10 if it depreciates like the typical vehicle.

At the end of that 5 year period, you’ll have lost about $8k in value. But that’s a whole heck of a lot better than the $21k of value lost in the first 5 years after buying the new car!

You might be saying to yourself, big whoop. That’s a sacrifice I am willing to make so I can drive in comfort and not embarrass myself.

Fair enough. But think about the value of $13k of savings if you invest in the stock market at an 8% return. $13k saved at age 25 would grow to over $192k by age 60 if it earned 8% annually. And that’s just from avoiding purchasing a new car one time in your life!

If you make a habit of buying reasonably priced used cars for your entire life, and simply invest all the extra money you are able to save, you’re destined for millionaire status by the time you want to retire. Do you really need the biggest SUV or the top of the line heavy-duty truck? Or is that just what you’ve been telling yourself all these years…

2. Drive your car for a lonnnggg time

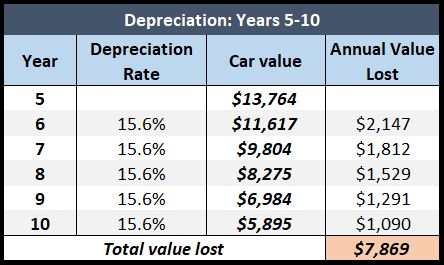

Each year that you are able to keep driving your old car is another year that you’re saving money. Remember how that new car depreciated by over 20% in the first year? That’s $8k down the drain in one year. On the other hand, my 15 year old Camry might have lost maybe $500 bucks in value last year—at most! Look how slowly old cars lose value since they’re worth so little to begin with:

Driving a car for a long time also means no car payment! Don’t buy into the lie that car payments are something you’ll simply be stuck with the rest of your life. Just buy a cheaper car (preferably with cash so you don’t have to pay interest) and drive it until it’s old. By driving your car for years and ridding yourself of a habitual car payment, you’ll have much more freedom for other things.

Lastly, but it’s worth mentioning, your older car will also come with the benefit of much lower insurance costs! Monthly premiums to insure an old $3,000 sedan are certainly a fraction of what you’d be paying to insure that $35k SUV you were eyeing.

But, but, but, I need a new car because…

1. I need it to be reliable and safe

To that I say: do a little research and buy something with good reviews. Most Toyotas and Hondas will drive for a couple hundred thousand miles if you give them the chance. And even if you do have to make the occasional repair here and there, the cost will pale in comparison to the amount you’ve saved vs. buying a new car.

I also get that car safety is continually improving each and every year, which is another reason some people like to buy new. But are you always going to be able to own the safest model available? Nope. Only if you buy a new car every year. There is a happy middle ground. If this is really a legitimate concern for you, you can look up lists like this of used cars that still get top safety ratings

2. It will last me longer

Okay, you’re right. Your new car will last a couple years longer than if you buy it used. However, I’d like to argue that most people who feel the need to buy a brand new car aren’t going to be the same ones who are willing to hold onto it for its 15+ year life. It’ll have been traded in long before it dies for good.

3. I like how new cars look and feel

Now we’re talking! This is a solid reason for wanting a new car. You like luxury. You like to impress people. You like things that are new.

That’s completely understandable. It’s normal. But I don’t want you to be normal. Normal people are broke.

What I want you to understand is that spending money on a new car means you have to sacrifice somewhere else. This could mean less money to spend on your housing, paying off your student loans, or investing. It could mean the difference between being able to retire at 57 or 67. Every decision you make is a tradeoff vs. something else. Is a new car a good enough reason to sacrifice in other areas of your life? Is a new car at age 25 worth robbing your future self of quite possibly hundreds of thousands of dollars?

If you honestly think that vehicles bring that you much satisfaction, then buy whatever the heck you want. Just understand how much it’s truly going to cost, and how much it’s likely setting your finances back.

Cars can help transport you anywhere you need to go, but not to financial freedom. Think about that the next time you see a car that you’re dying to have.