We have a retirement crisis on our hands in the United States. A recent survey indicated that 42% of Americans have less than $10,000 saved for retirement. This is a real problem. Let me give you some context.

When the Social Security Act was passed in 1935, the retirement age was set at 65. But the average life expectancy was only 58. You most likely worked right up until you died! However, Americans are now living closer to 80 years on average, and it’s not uncommon for some to even pass the century mark. That could potentially mean a retirement of more than three decades—slightly different than what President Roosevelt was envisioning in 1935.

Most people now expect to be able to end their lives with decades of relaxation and freedom from the workforce. In that regard, we’re much more fortunate than the generations that have come before us. It’s a concept that would have seemed crazy 100 years ago to anyone except the ultra-wealthy.

But this creates a problem: we expect this lifestyle in our later years, but we don’t prepare or plan for it.

Think about it. Those are a lot of years of living without having a regular income from a job. That requires quite a bit of money. Which is why it saddens me when I sometimes hear these common excuses from younger people justifying their lack of preparation:

- It’s so far off in the future – I’ll wait to start planning until I am more established in my career.

- I don’t even know what I am going to be doing next year, so I’m not going to waste my energy thinking about something that’s 30-40 years away.

- I just don’t have the time or extra money to be saving for retirement right now.

It’s thoughts like these that lead to 42% of Americans having less than $10,000 saved for retirement. Do you really want to have to be dependent on a small social security stipend as your only income for decades? That doesn’t sound fun to me.

What you really need are income-producing assets.

Why I think even a 20-year old needs to plan for retirement:

Compound Interest. Compound Interest. Compound Interest.

If you’ve read any of my other articles, I hope you’re picking up on the importance of this. The key to investing is to start early. It will make your life so much easier down the road. I highly recommend you go back and read the story of James and Fred, to learn why starting early matters.

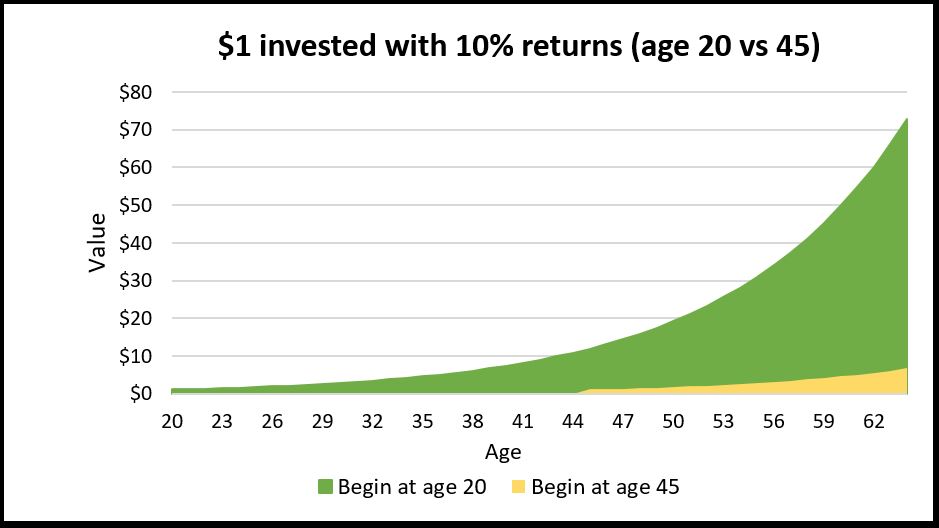

This illustration captures the main point though: Assuming a 10% annual return on your investment, $1 invested at age 20 will have grown to $72 at age 65. $1 invested at age 45, will have grown to… $6.

Help yourself out and avoid the heavy lifting by investing early. Time is your friend, and you don’t want to squander it. Your 20s are the most opportune time to set yourself up for a great financial future.

So how do I actually save for retirement?

I’ve talked a lot about investing and the reasons why you absolutely need to be taking advantage of it. But what I haven’t really mentioned is the actual process for doing so. Let me try to help you out.

Start by setting up tax-advantaged retirement accounts

The government loves to collect taxes, and it will do so in as many ways as it can.

First you get taxed on your income—those pesky withholdings that cut your paycheck down oh so much. If you then decide that you want to invest your money in a regular investment account, you’ll also get taxed on your profits whenever you sell your investments! So essentially, they take a chunk on the front end and a chunk on the back end!

Fortunately, the government has decided that they want to be nice to us in order to incentivize retirement savings. The IRS allows you to establish retirement accounts that help cut down on this tax burden while saving for retirement. The two main tax-advantaged accounts I want to discuss are the 401(k) and the Individual Retirement Account.

1. The 401(k)

401(k)s are accounts that are provided by your employer. Company 401(k)s allow you to invest a portion of your paycheck before taxes are taken out. You simply specify how much of your paycheck you want put into this account, and then it automatically gets deducted from your paycheck before the money ever even hits your bank.

It’s out of sight, out of mind.

401(k) Benefits

Remember how you’re essentially getting taxed twice in a regular investment account? With a 401(k), you bypass the upfront taxes and only end up paying income taxes on the back end when you go to withdraw money from the account. It’s called tax-deferral. If you don’t know why that’s good, you’re not alone—I’ll explain.

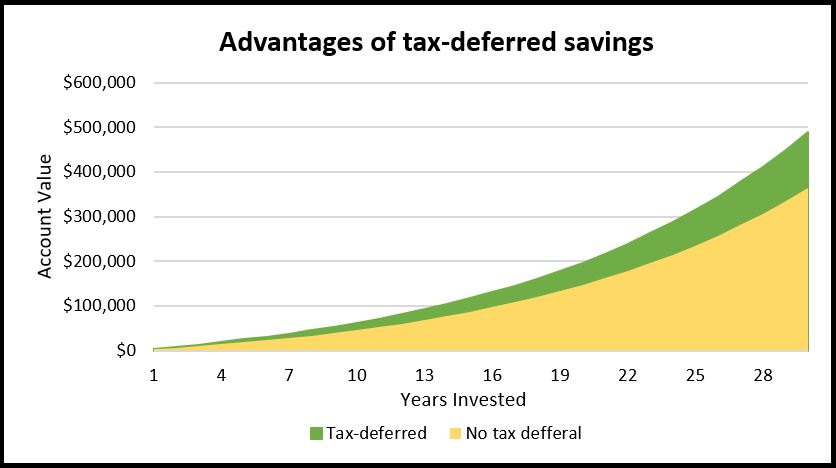

First, it gives you the advantage of investing pre-tax money. You get to invest your full gross pay before taxes even get taken out! Look at this chart below that shows the power of investing money that has not been taxed. This chart compares if you were to invest $4,000 of pre-tax money per year at a 10% return vs. only $3,000 per year (assuming you had to pay 25% taxes).

Over time, the increased amount you are able to invest due to tax deferral can boost your total ending value by hundreds of thousands of dollars! Make sure that you are taking advantage of this benefit, because it can make a huge difference come retirement time.

Secondly, tax deferral also provides a great benefit to people in high tax brackets, because they can avoid paying tax until retirement (when they’ll likely be in a lower bracket with less income).

But wait, there’s more!

Additional 401(k) benefit: The Match

Many companies will also offer “401(k) matches.” For example, a company may match your contributions up to, say, 4% of your income. So if you make $40,000 and put $1,600 into your 401(k) (4% of your salary), your employer will contribute another $1,600. FOR FREE.

It’s literally free money that you can be earning. EVERYONE should do their best to at least contribute up to the employer match if that is offered at your company. If you don’t know if it is, find out. A 4% 401(k) match is roughly equivalent in value to getting one additional 2 week paycheck for the year! So you have no excuse for not spending 30 minutes to look into it and set it up…

I’ve seen people wait in line for an hour at Chipotle on Halloween to simply save $3 on a half-priced burrito… come on people.

401(k) Restrictions

Unfortunately, there are a couple small drawbacks and limitations with 401(k)s. First, you can’t enjoy unlimited tax free contributions. The government limits your annual contribution in this account to $18,500 per person for 2018—unless you are over 50, and then you’re allowed $24,500 (these limits will increase by $500 in 2019). Additionally, you can’t withdraw the money until you are 59 ½ (with some exceptions) or else you’ll be facing a 10% penalty on your withdrawal, plus the income taxes.

Treat this as a retirement fund and not an “emergency fund” where you withdraw money to fund your next bathroom renovation…

How do I set up my 401(k)?

It should be pretty easy. Just enroll in your company’s 401(k) plan and choose how much of your paycheck you want to contribute. If you’re lost, talk to someone in Human Resources or the benefits department of the company to get you started. If you work in a small business, you may have to just ask the boss.

2. THE IRA

The Individual Retirement Account is an account you can set up without your employer. There are two types: a traditional IRA and a Roth IRA.

A traditional IRA functions almost the same way as a 401(k), except without your company involved. The money you put into that account is tax deductible (meaning you don’t have to pay income taxes on it for that year). Like a 401(k), you will have to pay income taxes when you go to withdraw the money in retirement though.

Traditional IRAs are great for people in high tax brackets who would be facing high current income taxes.

A Roth IRA has one small distinction, and is the type of IRA that I currently prefer. In a 401(k) or traditional IRA you avoid taxes upfront but pay at the end when you withdraw. With a Roth IRA, it’s the opposite. You contribute to it with after-tax income and then you never have to pay taxes again. The money grows tax-free for years and years and the tax man never shows up in retirement. This is an incredible option for retirement savings, because it completely eliminates all future tax liability. Your investments can grow into hundreds of thousands or even millions of tax-free dollars for you to retire with.

It’s an awesome option for those who are currently in middle to low tax brackets. You pay a small income tax bill today and then the money is yours forever.

If you are a young person with an average (or below) income, this is the account for you. Don’t procrastinate on setting up a Roth IRA! Take this free tax gift that the federal government is willing to give you! It’s a no-brainer decision that will pay off tremendously.

IRA restrictions

The government caps 2018 IRA contributions at $5,500 for those under 50 (rising to $6,000 in 2019). And those over 50 are allowed up to $6,500. Like the 401(k), it’s supposed to be treated as a long-term investment vehicle, and you will face penalties for withdrawing before 59 ½ years old. Technically, you are allowed to withdraw your contributions penalty-free before then, but I’d suggest you make every effort to avoid doing that. Don’t rob your future self by digging into your retirement savings.

Also, to qualify for an IRA, your adjusted gross income must be below $135k if you are single or $199k if you’re married. If this is a problem for you, well… congrats!

How do I set up an account?

I suggest using Vanguard for your IRA. They consistently seem to have the lowest fees in the industry and are generally just the best. Vanguard doesn’t have any shareholders or outside owners and is instead owned by people like you and me who own the Vanguard funds. This allows them to keep fees very low, because they do not have to make a big profit for any shareholders!

You can set up an account on their website, deposit money from your bank account, and be on your way to retirement success.

I have my 401(k) and IRA account set up, now what do I do?

Remember, a 401(k) or an IRA is simply the account that you are using. It’s just a vehicle that helps protects your investments from taxes. You need to actually buy investments within these accounts if you want your money to grow. I heard a story about a lady who had been contributing to a Roth IRA for 13 years, but she didn’t realize that she was supposed to invest her cash contributions. I can’t imagine how disappointed she was after finding out she missed out on tens of thousands of dollars of potential growth.

Don’t make that mistake!

I recommend investing in a Total Stock Market Index Fund. Check out “How to invest” if you would like to learn more about why. It’s is a great long term investment that is diversified across every single industry in the United States. Historically, it has returned on average 10% per year (about 7% once you factor in inflation). Those 10% returns are not typical for a calendar year though, because the stock market normally swings up and down fairly dramatically from year to year (it would be more likely for the fund to go up 25% one year and down 10% the next).

Because it can be so volatile, if you are getting close to retirement and need begin to live off of your savings within the next 10 years, you may want to diversify by also buying a fixed-income bond fund.

What do I do with my account after it’s set up and I am invested?

Make sure to contribute more each and every year! Whatever you do, DO NOT sell when the market goes down. If you are more than 10 years away from retiring, you should actually be cheering for the market to go down so you can be buying more at cheaper prices!

Like I mentioned earlier, these retirement accounts generally (with some exceptions) make you pay a 10% penalty on anything you would withdraw before age 59 ½. So do your best to just let it sit there and grow!

Your takeaway action items:

- Recognize that you need to be saving for retirement no matter how old you are.

- Check to see if your company offers a 401(k) match. If so, contribute at least enough to receive the full match. Get your free money!

- In addition to your 401(k), contribute each year to your IRA. A Roth IRA is the best option for those making middle class or lower incomes.

- Invest in diversified stock index funds like the Total Stock Market Index.

- Continue to make investments every single year whether the market goes up or down.

- Sit back, relax, and let your money work for you.

If you fail to plan you are planning to fail. Do something today that will set yourself up for a better tomorrow.

This Post Has 4 Comments

Excellent article

Thanks a lot Kyle!

Josiah – these articles are excellent! Super informative and great for young people. I have been sending them to my friends who are unsure about how to handle money. Thanks for posting them!

Thanks Claire! That’s exactly why I do them. Hope I can keep writing some good ones for you!